Fonds de commerce à vendre LALOUBERE (65)

-

area

378 m2

Presentation of the property : business goodwill 14 rooms for sale in LALOUBERE

Cause départ en retraite, cet hôtel/bar/ restaurant ne demande qu'à rouvrir ses portes pour satisfaire à nouveau toutes les papilles et passer des moments conviviaux en terrasse.

L'ensemble du matériel et des lieux est en parfait état : salle de restaurant (80 couverts) ainsi qu'une terrasse, bar fonctionnel, cuisine équipée d'un piano, plancha, friteuse, hotte inox, four à air pulsé, gastro avec plateau.........

Le sous-sol offre une capacité de stockage de 130 m² avec chambre froide, chaufferie.....

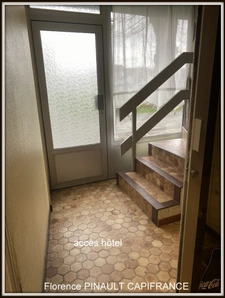

Vous disposerez d'une entrée indépendante pour accéder à un hôtel de 8 chambres sur 2 niveaux avec literie récente, sanitaires, TV, menuiseries double vitrage, volets roulants électriques............

Vous disposerez d'un appartement de fonction T4 au 1er étage.

Un tablier, des sourires et vous ne serez pas déçus!!!!!!!!!!!

Loyer fonds: 1200 euros ht

Loyer appartement : 400 euros hc

Les informations sur les risques auxquels ce bien est exposé sont disponibles sur le site Géorisques : www. georisques. gouv. fr.

Réseau Immobilier CAPIFRANCE - Votre agent commercial (RSAC N°817 414 915 - Greffe de TARBES) Florence PINAULT Entrepreneur Individuel 06 01 06 02 83 - Réf.888879

Features of this property :

| 340 934 658 748 | |

| 14 | |

| 378 m² | |

| 1940 | |

| South |

| yes |

Capifrance advisor in charge of this property

Investing in commercial properties can offer several attractive advantages for investors. Here are some reasons why this type of investment can be appealing:

High returns

Tenant stability: Businesses tend to sign long-term leases (often between 3 and 9 years). This provides stable rental income over the long term and reduces the risk of vacancy.

Property appreciation: Commercial properties can increase in value over time, especially if they are located in developing areas or thriving business districts.

Diversification opportunities: Investing in commercial properties allows for the diversification of an investment portfolio. This helps reduce risks by spreading investments across different types of real estate assets (offices, retail spaces, warehouses, etc.).

Less daily management: Compared to managing residential properties, commercial properties require less daily management. Tenant businesses are generally responsible for routine maintenance.

There is no tacit renewal. The tenant must request the renewal of the lease 6 months before the lease's expiration. This request cannot be refused.

In the case of tacit extension, the conditions of the initial lease continue to apply, but the parties can terminate the lease at any time, subject to a notice period. The terms of the lease (rent, charges, etc.) continue to apply. If the lease duration exceeds 12 years, the landlord can uncap the rent (i.e., the rent will be set at the market rental value commonly practiced in the vicinity).

Valuing a business requires a comprehensive approach, taking into account the financial, commercial, material, and immaterial aspects of the company. Consulting a specialist in business valuation can also help to obtain an accurate and professional estimate.

Do you need advice for your real estate project? Contact a Capifrance advisor

Find out the market price of your property