OASIS DE SERENITE : DOMAINE TOURISTIQUE D'EXCEPTION

-

area

1100 m2

-

land

5988 m2

Presentation of the property : Shop 16 rooms for sale in SAINTE ANNE

Ce domaine touristique clé en main offre une forte rentabilité et de nombreuses possibilités d'expansion, que ce soit par l'ajout de services complémentaires, des extensions ou d'autres aménagements.

Le domaine est composé d'un ensemble de plusieurs bâtiments implanté sur un terrain de près de 6 000m2 en parfait état.

Reconnu et renommé, ce ressort bénéficie d'avis clients excellents, garantissant une réputation solide.

Pour toutes informations complémentaires, veuillez me contacter.

Un dossier complet est disponible sous engagement de confidentialité.

Les frais de notaire ou d'avocat sont à la charge de l'acquéreur.

Il est également possible de procéder à une cession de parts sociales pour la vente.

Les honoraires d'agence sont à la charge de l'acquéreur, soit 5,66% TTC du prix hors honoraires.

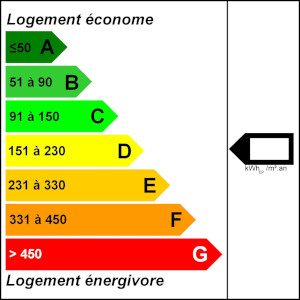

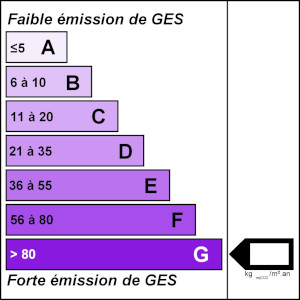

Le Diagnostic de Performance Énergétique(DPE) a été réalisé selon une méthode valable mais non fiable et non-opposable.

Les informations sur les risques auxquels ce bien est exposé sont disponibles sur le site Géorisques : www. georisques. gouv. fr.

Réseau Immobilier CAPIFRANCE - Votre agent commercial (RSAC N°894 608 066 - Greffe de POINTE A PITRE) Magali GOURDAIN Entrepreneur Individuel 06 90 09 07 52 - Réf.882777

Price excluding fees 2 650 000 €

Fees payable by the buyer are 5.66% all taxes included

Features of this property :

| 340 932 106 537 | |

| 16 | |

| 1 100 m² | |

| 5 988 m² |

| yes | |

| yes |

| 2 800 000 € | |

| 19 944 € |

Capifrance advisor in charge of this property

Investing in commercial properties can offer several attractive advantages for investors. Here are some reasons why this type of investment can be appealing:

High returns

Tenant stability: Businesses tend to sign long-term leases (often between 3 and 9 years). This provides stable rental income over the long term and reduces the risk of vacancy.

Property appreciation: Commercial properties can increase in value over time, especially if they are located in developing areas or thriving business districts.

Diversification opportunities: Investing in commercial properties allows for the diversification of an investment portfolio. This helps reduce risks by spreading investments across different types of real estate assets (offices, retail spaces, warehouses, etc.).

Less daily management: Compared to managing residential properties, commercial properties require less daily management. Tenant businesses are generally responsible for routine maintenance.

There is no tacit renewal. The tenant must request the renewal of the lease 6 months before the lease's expiration. This request cannot be refused.

In the case of tacit extension, the conditions of the initial lease continue to apply, but the parties can terminate the lease at any time, subject to a notice period. The terms of the lease (rent, charges, etc.) continue to apply. If the lease duration exceeds 12 years, the landlord can uncap the rent (i.e., the rent will be set at the market rental value commonly practiced in the vicinity).

Valuing a business requires a comprehensive approach, taking into account the financial, commercial, material, and immaterial aspects of the company. Consulting a specialist in business valuation can also help to obtain an accurate and professional estimate.

Do you need advice for your real estate project? Contact a Capifrance advisor

Find out the market price of your property