Local/bureau ou apt de 81 m²

-

area

81 m2

Presentation of the property : business assets 3 rooms for sale in AULNAY SOUS BOIS

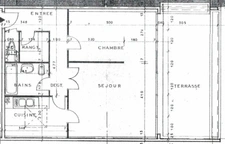

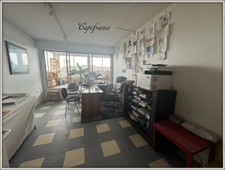

Situé au 4ième étage avec ascenseur, cet apt propose une vaste entrée, 2 grandes pièces de 16 et 18 m² prolongées d'une véranda de 21 m², d'une salle d'eau toute neuve, de wc séparés et d'une cuisine ouverte aménagée.

Climatisation réversible.

Electricité aux normes.

Peut être réemployé en apt ou en activité professionnelle de type médicale (kyné, infirmières...)

Apt aux normes PMR.

Très lumineux

Présence d'une grande cave en sous-sol. (12 m²)

Charges de 450 euros/trimestre.

Taxe foncière 1230 euros. Nombre de lots de la copropriété : 42, Montant moyen annuel de la quote-part de charges (budget prévisionnel) : 1800€ soit 150€ par mois. Les honoraires sont à la charge du vendeur.

Les informations sur les risques auxquels ce bien est exposé sont disponibles sur le site Géorisques : www. georisques. gouv. fr.

Réseau Immobilier CAPIFRANCE - Votre agent commercial (RSAC N°519 147 672 - Greffe de BOBIGNY) Valérie RIVIERE Entrepreneur Individuel 06 78 96 61 22 - Réf.911195

Fees payable by the seller

Features of this property :

| 340 935 952 673 | |

| 3 | |

| 81 m² | |

| 81,05 m² | |

| 4 | |

| 1977 |

| yes |

| 233 000 € | |

| 1 228 € |

Average energy prices indexed as of January 1, 2021 (subscriptions included)

Capifrance advisor in charge of this property

Investing in commercial properties can offer several attractive advantages for investors. Here are some reasons why this type of investment can be appealing:

High returns

Tenant stability: Businesses tend to sign long-term leases (often between 3 and 9 years). This provides stable rental income over the long term and reduces the risk of vacancy.

Property appreciation: Commercial properties can increase in value over time, especially if they are located in developing areas or thriving business districts.

Diversification opportunities: Investing in commercial properties allows for the diversification of an investment portfolio. This helps reduce risks by spreading investments across different types of real estate assets (offices, retail spaces, warehouses, etc.).

Less daily management: Compared to managing residential properties, commercial properties require less daily management. Tenant businesses are generally responsible for routine maintenance.

There is no tacit renewal. The tenant must request the renewal of the lease 6 months before the lease's expiration. This request cannot be refused.

In the case of tacit extension, the conditions of the initial lease continue to apply, but the parties can terminate the lease at any time, subject to a notice period. The terms of the lease (rent, charges, etc.) continue to apply. If the lease duration exceeds 12 years, the landlord can uncap the rent (i.e., the rent will be set at the market rental value commonly practiced in the vicinity).

Valuing a business requires a comprehensive approach, taking into account the financial, commercial, material, and immaterial aspects of the company. Consulting a specialist in business valuation can also help to obtain an accurate and professional estimate.

Do you need advice for your real estate project? Contact a Capifrance advisor

Find out the market price of your property